3D printing global market

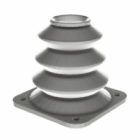

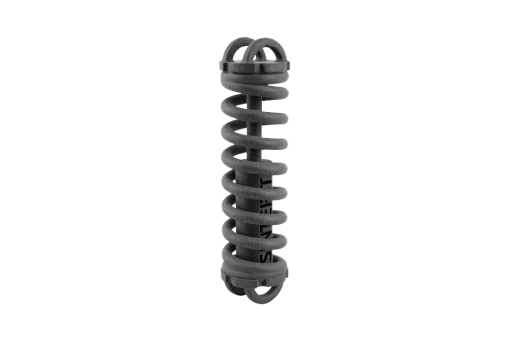

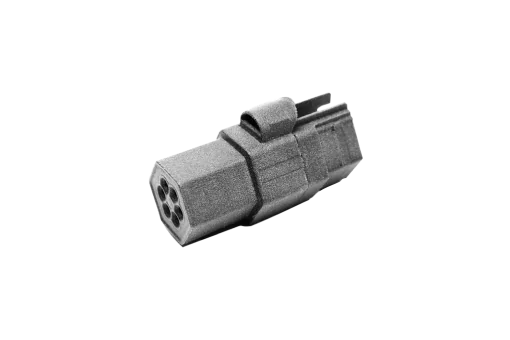

3D printing has evolved far beyond its early image as a prototyping tool. Today, it’s a strategic manufacturing method gaining momentum across multiple industries. From aerospace and healthcare to automotive and consumer goods, additive manufacturing is becoming a pillar of modern production. But just how big is the market — and where is it heading?

Global forecasts offer a clear picture of rapid growth. Estimates for 2025 place the additive manufacturing market at around $16–20 billion, with projections reaching $80 to over $130 billion by 2030–2035, depending on the source. These values vary depending on whether the forecast refers only to hardware or to the entire ecosystem of hardware, materials, and services — some reports treat these segments separately. These aren’t just optimistic figures — they reflect the shift from experimentation to real production, including serial manufacturing, digital warehousing, and tooling applications that increasingly rely on AM.

This growth is driven not only by more powerful machines and a wider range of materials but by a change in mindset. Companies are moving from mass production to smart, distributed, and digital-first manufacturing strategies — and 3D printing fits perfectly into that transformation.

What’s fueling the expansion?

The global expansion of additive manufacturing isn’t based on a single breakthrough — it’s a convergence of several factors. One is the growing maturity of industrial-grade 3D printers, which now offer high throughput, reliability, and precision. Another is the increasing availability of high-performance materials, including engineering polymers, metals, and composite blends, such as carbon-fiber-reinforced nylons or high-temperature polymers for aerospace certification, that match — and sometimes outperform — traditional manufacturing materials.

At the same time, global supply chain disruptions have made companies rethink just-in-time production and decentralized manufacturing. 3D printing enables exactly that: the ability to produce parts locally, on demand, without relying on overseas tooling or high inventory levels. This supports digital inventory strategies, where parts exist as 3D models rather than physical stock, reducing storage and tooling costs. It’s not just cost efficiency that matters — it’s resilience, speed, and adaptability.

Governments and large manufacturers are also investing heavily in additive manufacturing, creating hubs, accelerating R&D, and developing national strategies to support its integration into mainstream industry.

How it plays out across the world

The United States, Europe, and China lead the global 3D printing market in terms of installed systems and R&D. North America is home to many of the key players — from printer manufacturers to software developers — and continues to dominate in terms of patents and innovation. Europe, meanwhile, is a hub for high-end metal AM and industrial SLS. The region is also advancing AM adoption through EU-funded programs, standardization work, and strong involvement of companies like EOS, SLM Solutions, and Voxeljet. Germany in particular plays a central role thanks to its strong manufacturing and engineering sectors.

In Asia, China, Japan, and South Korea are aggressively investing in large-scale applications, particularly in automotive, construction, and consumer products. These markets are focusing not just on machines, but on entire AM ecosystems — integrating software, simulation, post-processing, and AI-driven optimization.

Not without challenges

Even with rapid growth, the market still faces challenges. Adoption in heavily regulated industries like aerospace or healthcare requires extensive validation and certification including compliance with ISO/ASTM 52900-series standards that define processes, terminology, and quality requirements in AM. There’s also the cost barrier: industrial systems and high-performance materials are still expensive for many small and medium-sized companies.

Skills remain a bottleneck too, especially in areas like Design for Additive Manufacturing (DfAM), process optimization, and post-processing. Designing for additive manufacturing requires a different mindset than designing for injection molding or CNC. Companies must upskill teams or bring in new talent — both of which take time and investment.

Looking ahead

The global market for 3D printing is entering a phase where scale, specialization, and ecosystem thinking become key. Instead of just asking what printers can do, companies are asking how 3D printing can reshape their operations — from prototyping and tooling to full-scale production and aftermarket support.

Automation is also becoming a critical element — from powder handling systems to MES platforms that track production workflows across multiple printers. As hardware, software, and materials continue to converge, the most successful applications won’t necessarily be the flashiest. They’ll be the ones that solve real problems in manufacturing, design, or supply chain operations. And based on current growth rates and investment patterns, those applications are becoming more widespread with each passing year.

Explore also

- What is print 3D? Concept of 3D printing

- What does “3D printed” mean?

- Example of 3D printing

- How does 3D printing work?

- Slicing in 3D printing

- What do you need for 3D printing?

- 3D printing benefits

- Is 3D printer dangerous? Understanding the real risks

- 3D printing issues

- 3D printing history

- 3D printing facts

- Who uses 3D printers? Not just for engineers anymore

- Where 3D printing is used

- 7 common 3D printing myths

- Cultural impact of 3D printing

- Hybrid manufacturing (CNC + AM)

Related categories

Austria

Austria  Bosnia and Herzegovina

Bosnia and Herzegovina  Bulgaria

Bulgaria  Croatia

Croatia  Czech Republic

Czech Republic  Denmark

Denmark  Estonia

Estonia  Finland

Finland  France

France  Germany

Germany  Greece

Greece  Hungary

Hungary  Ireland

Ireland  Italy

Italy  Latvia

Latvia  Lithuania

Lithuania  Poland

Poland  Portugal

Portugal  Romania

Romania  Slovakia

Slovakia  Slovenia

Slovenia  Spain

Spain  Sweden

Sweden  Switzerland

Switzerland  United Kingdom

United Kingdom  Ukraine

Ukraine  China

China  Hong Kong

Hong Kong  India

India  Israel

Israel  Japan

Japan  Malaysia

Malaysia  Philippines

Philippines  Saudi Arabia

Saudi Arabia  South Korea

South Korea  Taiwan

Taiwan  Thailand

Thailand  Turkey

Turkey  United Arab Emirates

United Arab Emirates  Egypt

Egypt  South Africa

South Africa  Tunisia

Tunisia  Canada

Canada  Mexico

Mexico  United States

United States  Brasil

Brasil  Colombia

Colombia  Australia

Australia  New Zealand

New Zealand